US Tariffs: Monday's Impact on Chinese Investors

Monday's announcement of new US tariffs sent shockwaves through Chinese financial markets, leaving investors grappling with uncertainty and potential losses. The impact wasn't uniform; some sectors felt the sting more acutely than others, highlighting the complex and interconnected nature of global trade. This article delves into the immediate consequences of the tariff announcement, examining its effect on various investment sectors and exploring the potential long-term implications for Chinese investors.

Immediate Market Reactions

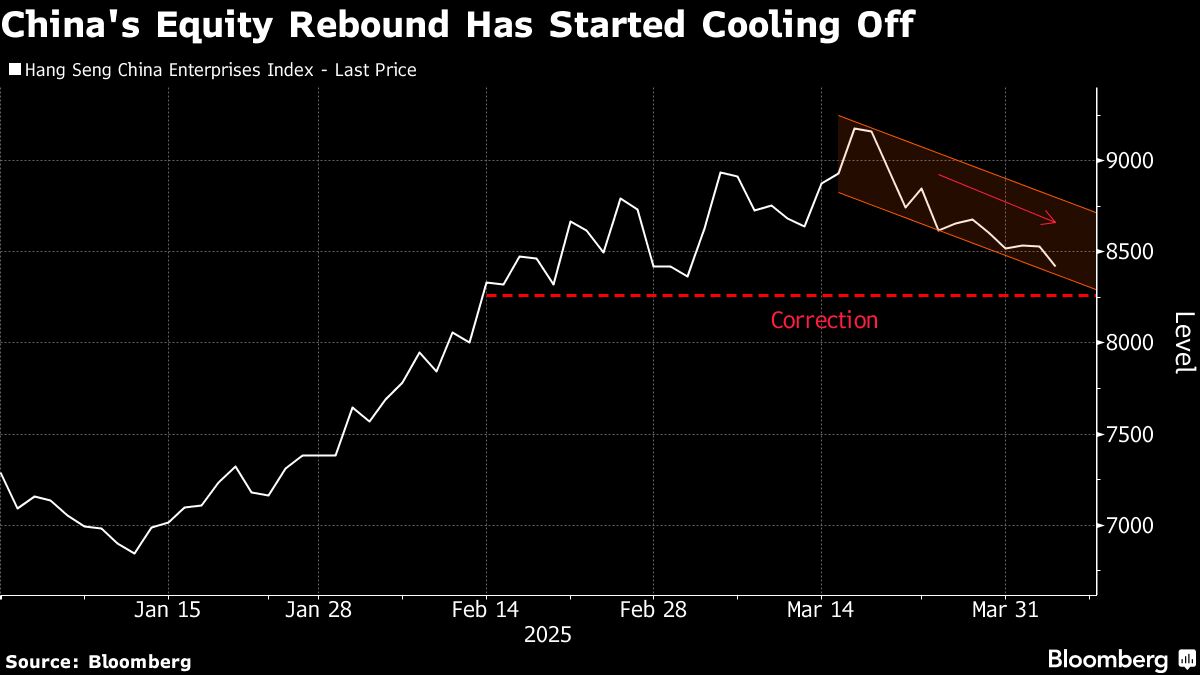

The news broke early Monday morning, triggering a swift sell-off across major Chinese stock exchanges. The Shanghai Composite Index experienced a significant dip, losing [insert percentage]% in early trading. Similarly, the Shenzhen Component Index also saw a notable decline. This immediate reaction underscores the sensitivity of Chinese markets to US trade policy. The uncertainty surrounding the tariffs' ultimate impact fueled a wave of risk aversion, prompting investors to liquidate assets and seek safer havens.

- Tech Sector Hit Hard: The technology sector bore the brunt of the impact, with shares in major Chinese tech companies falling sharply. This is likely due to the significant reliance of these companies on US markets and technology. The tariffs directly impact the cost of importing US components and exporting finished products.

- Consumer Goods Affected: The consumer goods sector also experienced a downturn, although less dramatically than the tech sector. Increased tariffs on US imports could lead to higher prices for Chinese consumers, potentially dampening demand.

- Currency Fluctuations: The Chinese Yuan experienced some volatility, weakening slightly against the US dollar in the aftermath of the tariff announcement. This reflects the broader uncertainty in the market and the potential for reduced capital inflows.

Long-Term Implications: A Cloudy Forecast

The long-term implications of these tariffs remain uncertain. However, several potential scenarios are worth considering:

- Increased Inflation: Higher import costs resulting from the tariffs could contribute to inflation in China, potentially eroding consumer purchasing power.

- Supply Chain Disruptions: Chinese companies may need to adjust their supply chains, potentially seeking alternative sources for US-made components or shifting production to other countries. This process could be costly and time-consuming.

- Retaliatory Measures: The Chinese government could retaliate with its own tariffs or trade restrictions, further escalating tensions and potentially damaging both economies.

- Investment Diversification: Chinese investors may be incentivized to diversify their portfolios, reducing their dependence on US markets and exploring opportunities in other regions.

Strategies for Chinese Investors

In light of this heightened uncertainty, Chinese investors need to adopt a cautious approach. Strategies to consider include:

- Diversification: Diversifying investments across different asset classes and geographies is crucial to mitigate risk.

- Risk Assessment: Thorough due diligence and a comprehensive understanding of the potential impact of US tariffs on specific investments are essential.

- Hedging Strategies: Employing hedging strategies to protect against currency fluctuations and other market risks is advisable.

- Seeking Professional Advice: Consulting with financial advisors who possess expertise in navigating international trade complexities is highly recommended.

Conclusion: Navigating the Uncertain Terrain

Monday's tariff announcement highlights the precarious nature of global trade and the significant impact of US policies on Chinese markets. While the immediate reaction was negative, the long-term consequences remain to be seen. Careful planning, diversification, and professional advice are crucial for Chinese investors looking to navigate this uncertain terrain and mitigate potential losses. The situation requires constant monitoring and a flexible investment strategy to adapt to evolving circumstances. Further analysis and updates will be provided as the situation unfolds.

Keywords: US Tariffs, China, Chinese Investors, Market Impact, Trade War, Investment Strategies, Economic Uncertainty, Shanghai Composite Index, Shenzhen Component Index, Yuan, Tech Sector, Consumer Goods

Note: Remember to replace "[insert percentage]%" with the actual percentage drop in the relevant indices on the day of the tariff announcement. This article provides a framework; you should conduct your own research and incorporate the latest data for accuracy and relevance. You should also add relevant links to reputable financial news sources and government websites.