China Market Jitters Ahead of US Tariff Response

Concerns mount as China braces for potential US tariff escalation, triggering market volatility and sparking anxieties about global economic stability.

The Chinese market is on edge as it awaits the US government's response to its recent trade actions. While the specifics remain shrouded in uncertainty, the potential for further tariff increases has sent ripples of anxiety throughout the Chinese economy and global markets. This uncertainty is fueling volatility and raising serious questions about the future of trade relations between the world's two largest economies.

A Tense Standoff:

The current situation stems from ongoing trade tensions between the US and China, a conflict that has significantly impacted global economic growth. China's recent actions, [cite specific recent actions and link to a reputable news source], have prompted speculation about a potential US counter-response. Market analysts are particularly concerned about the possibility of increased tariffs on Chinese goods, a move that could have significant consequences for both countries.

Impact on the Chinese Market:

The anticipation of a US tariff response is already having a noticeable impact on the Chinese market. We're seeing:

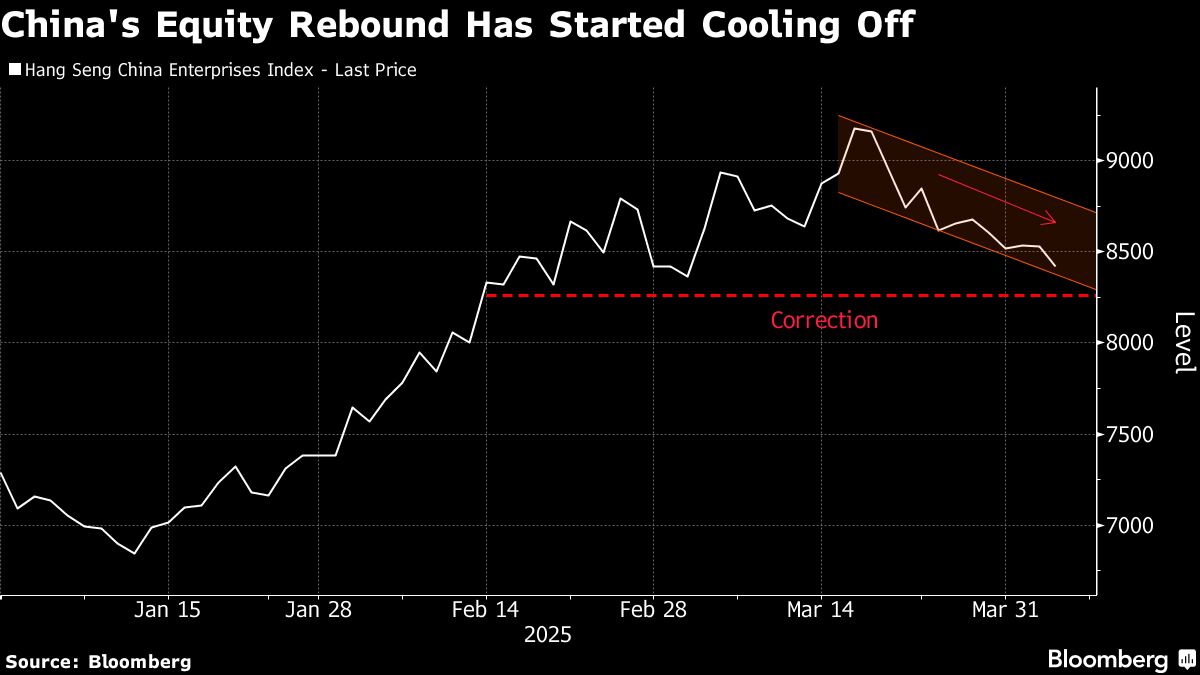

- Increased Volatility: Stock markets have experienced significant fluctuations, reflecting investor uncertainty. The Shanghai Composite Index, for instance, [cite recent index performance with a link to a reliable financial source], showcases this volatility.

- Currency Fluctuations: The Chinese Yuan has also shown signs of weakening against the US dollar, further exacerbating concerns. This reflects a potential flight of capital as investors seek safer havens. [Link to a reliable source showing currency fluctuations].

- Impact on Businesses: Chinese businesses, particularly those heavily reliant on exports to the US, are bracing for potential disruptions and increased costs. This uncertainty is hindering investment and potentially impacting job growth.

- Consumer Sentiment: The overall consumer sentiment is also likely to be negatively affected by the uncertainty. This could lead to reduced spending and a slowdown in domestic demand.

Global Implications:

The ongoing trade dispute between the US and China is not an isolated incident. It has broader implications for the global economy, impacting supply chains, investor confidence, and overall economic growth. A further escalation of tariffs could:

- Disrupt Global Supply Chains: Many global companies rely on Chinese manufacturing, and increased tariffs could disrupt these intricate supply chains, leading to higher prices for consumers worldwide.

- Reduce Global Trade: Increased trade barriers could lead to a significant reduction in global trade volumes, potentially hindering economic growth.

- Increase Inflation: Higher tariffs could lead to increased prices for goods and services, fueling inflation in both the US and China.

What Happens Next?

The coming weeks will be crucial in determining the future trajectory of US-China trade relations. The US government's response to China's recent actions will be closely watched by markets worldwide. Any escalation of tariffs could have significant and far-reaching consequences for the global economy.

Call to Action:

Stay informed about the latest developments in the US-China trade dispute by following reputable news sources and financial analysts. Understanding the complexities of this situation is crucial for businesses and investors navigating this period of uncertainty. [Link to a relevant financial news website or your own site's relevant content]