China Investors Fear US Tariff Retaliation: A Looming Economic Storm?

Introduction: Tensions between the United States and China have escalated once again, leaving Chinese investors deeply concerned about potential US tariff retaliation. The recent announcement of [mention specific recent event, e.g., new export restrictions or trade dispute escalation] has sent shockwaves through the Chinese market, sparking fears of further economic instability. This article explores the anxieties gripping Chinese investors and analyzes the potential consequences of escalating trade tensions.

The Current Climate of Uncertainty:

The relationship between the US and China has been characterized by periods of both cooperation and intense rivalry for years. However, recent events have significantly heightened the sense of uncertainty among Chinese investors. The imposition of [mention specific tariffs or restrictions] has raised concerns about a wider trade war, impacting everything from technology companies to agricultural exporters. This uncertainty is driving investors to seek safer havens and reassess their investment strategies.

- Concerns about retaliatory tariffs: Chinese investors fear that any further actions by the US government could trigger retaliatory measures from Beijing, further disrupting global supply chains and impacting market stability.

- Impact on foreign investment: The unpredictable nature of the US-China relationship is deterring foreign investment in China, as investors are hesitant to commit capital in an environment marked by considerable political and economic risk.

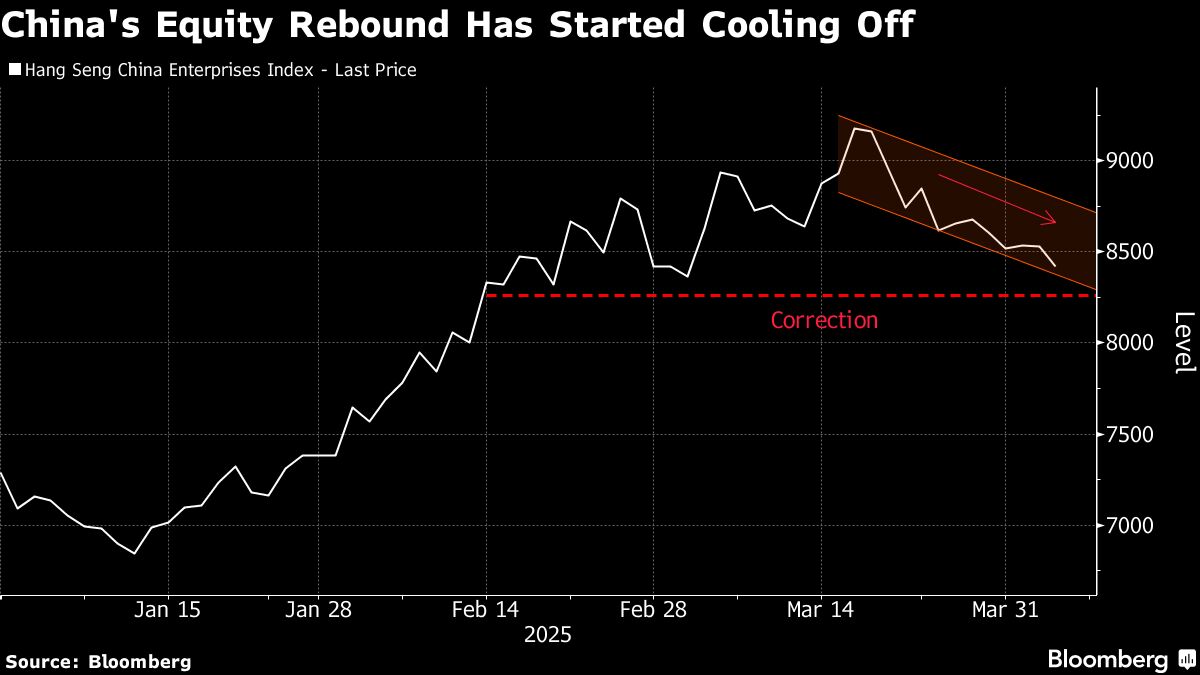

- Declining market confidence: The escalating tensions are leading to a decline in market confidence, causing a drop in stock prices and increased volatility.

The Impact on Specific Sectors:

Several key sectors in China are particularly vulnerable to US tariff retaliation:

- Technology: The tech sector is facing the brunt of the trade war, with restrictions on the export of semiconductors and other crucial components. This is severely impacting Chinese tech giants and startups alike.

- Agriculture: Chinese agricultural exports have been significantly affected by US tariffs, leading to lower prices and reduced profits for farmers.

- Manufacturing: The manufacturing sector, a cornerstone of the Chinese economy, is facing disruptions in supply chains and decreased demand for its products in the US market.

Strategies for Mitigating Risk:

Chinese investors are employing various strategies to mitigate the risks associated with potential US tariff retaliation:

- Diversification: Many investors are diversifying their portfolios, reducing their reliance on US markets and exploring opportunities in other regions like Southeast Asia and Africa.

- Risk management: Sophisticated risk management techniques are being implemented to assess and manage potential losses from trade disputes.

- Lobbying efforts: Chinese businesses are engaging in lobbying efforts to influence policy decisions and mitigate the impact of trade restrictions.

Looking Ahead: A Bleak Outlook or a Catalyst for Change?

The future remains uncertain. While the immediate outlook appears bleak for many Chinese investors, the current situation could also serve as a catalyst for change. It might accelerate China's efforts to become more self-reliant, reduce its dependence on foreign technology, and foster innovation within its own borders.

Conclusion:

The fear of US tariff retaliation is a significant challenge for Chinese investors. The uncertainty surrounding the US-China relationship is creating a volatile investment climate and impacting various sectors of the Chinese economy. While the situation is undoubtedly concerning, adaptability and strategic diversification will be key to navigating these turbulent waters. The long-term consequences of this trade conflict remain to be seen, but one thing is certain: the future of the global economy hinges, in part, on the resolution of these tensions.

Call to Action: Stay informed about the evolving US-China trade relationship by following reputable news sources and engaging in informed discussions. What are your thoughts on the future of US-China trade relations? Share your opinions in the comments below.